of the

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of Annual Meeting of Stockholders

Date: Wednesday, May 8, 2024 Time: 10:00 a.m. Central Daylight Time / 11:00 a.m. Eastern Daylight Time Virtual Location: http://www.virtualshareholdermeeting.com/MUR2024 | ||||

The 2024 Annual Meeting of Stockholders of Murphy Oil Corporation, a Delaware corporation, will be held on Wednesday, May 8, 2024, at 10:00 a.m. CDT, in a virtual-only format via live webcast at http://www.virtualshareholdermeeting.com/MUR2024. The Proxy Statement is first sent to stockholders on or about March 21, 2024.

Matters to be voted on:

Election of |

Directors;

| 2 | Advisory vote to approve executive compensation; |

| 3 |

NOTICE OF2018ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENTYOUR VOTE IS IMPORTANTPlease vote online, by mobile device, by telephone, or, if you receive your materials by mail, you can sign and return your proxy card.

NOTICE OF ANNUAL MEETING

AGENDA:

| Approval of the action of the Audit Committee of the Board of Directors in appointing KPMG LLP as the Company’s independent registered public accounting firm for |

Such other business as may properly come before the meeting. |

Record date:

Only stockholders of record at the close of business on March 12, 2018,11, 2024, the record date fixed by the Board of Directors of the Company, will be entitled to notice of and to vote at the meeting or any postponement or adjournment thereof. A list of all stockholders entitled to vote iswill be on file at the office of the Company, 300 Peach Street, El Dorado, Arkansas 71730.9805 Katy Freeway, G-200, Houston, Texas 77024, at least ten days before the meeting.

Your vote is very important to us and to our business. business:

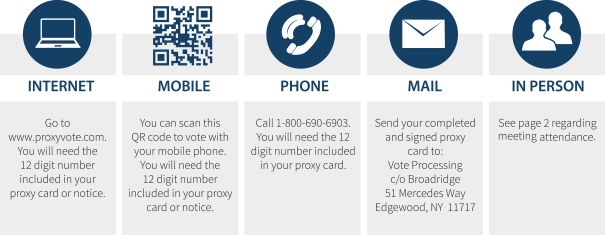

Prior to the meeting, you may submit your vote and proxy by telephone, mobile device, the internet, or, if you received your materials by mail, you can sign and return your proxy card. Instructions on how to vote begincan be found on page 1.50.

E. Ted Botner

Executive Vice President, LawGeneral Counsel and Corporate Secretary

El Dorado, Arkansas

March 23, 2018

|

|

|

Proposals to be Voted On

The following proposals will be voted on at the Annual Meeting of Stockholders.

|

| |||||

|

|

| ||||

|

| |||||

|

|

| ||||

| ||||||

|

|

| ||||

| ||||||

|

|

| ||||

| ||||||

|

|

| ||||

| ||||||

You may cast your vote in the following ways:

The 2018 Murphy Oil Corporation Annual Meeting will begin at 10:00 a.m. CDT on May 9, 2018,

at the South Arkansas Arts Center located at 110 East 5th Street in El Dorado, Arkansas 71730.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 9, 2018:8, 2024:

We have elected to take advantage of the U.S. Securities and Exchange Commission (the “SEC”) rules that allow us to furnish proxy materials to the Company’s stockholders via the internet. These rules allow us to provide information that the Company’s stockholders need while lowering the costs and accelerating the speed of delivery and reducing the environmental impact of the Annual Meeting. This Proxy Statement, along with the Company’s Annual Report to Stockholders, which includes the Company’s Form10-K report for the year ended December 31, 2017,2023, are available via the internet athttp://ir.murphyoilcorp.com/phoenix.zhtml?c=61237&p=proxy. www.proxydocs.com/MUR.

2024 PROXY STATEMENT i

Murphy Oil at a Glance

Our Social and Environmental Sustainability

| Our People |

Competitive compensation and benefits along with an inclusive work environment help us to attract and retain talented people, the real strength of our Company.

A summary of employee benefits, which may vary by country, is listed below:

| · | Medical, dental, and vision care coverage |

| · | Birth/Adoption leave for mothers and fathers |

| · | Expanded mental health network of providers and coverage for behavioral health |

| · | Health Savings/Flexible Spending Accounts |

| · | 401(k) Savings Plan with Company match |

| · | Defined-Benefit Pension Plan for all eligible employees |

| · | Life and AD&D Insurance Benefits |

| · | Employee Assistance Program |

| · | Employee Educational Assistance |

| · | Employee Gift Matching (as outlined in the Compensation Discussion and Analysis) |

Each year we review our benefits package and enhance it, when appropriate. For example, in 2023, we added more fund choices to the 401(k) Savings Plan, along with providing numerous financial wellness education sessions. We have been recognized by the Greater Houston Partnership as a “Best Place for Working Parents” from 2022 to 2024, and named one of “America’s Most Responsible Companies 2024” by Newsweek.

We continue to build upon our diversity, equity and inclusion efforts focusing on (i) building strategic recruiting relationships, (ii) training and development opportunities, (iii) exploring partnerships with minority and women-owned businesses, (iv) employee engagement, and (v) participation in events hosted by external organizations. We have expanded our diversity disclosures in our Sustainability Report and have published our annual Equal Employment Opportunity (EEO-1) filings on our website.

| Climate Change |

We understand that our industry, and the use of our products, create emissions – which raise climate change concerns. At the same time, access to affordable, reliable, secure energy is essential to improving the world’s quality of life and the functioning of the global economy. We believe that as the energy economy transitions under the Paris Agreement, oil and natural gas will continue to play a vital role in the long-term energy mix.

We are committed to reducing our greenhouse gas (GHG) emissions and focused on understanding and mitigating climate change risks. The Board of Directors actively oversees climate-related risks and opportunities, as well as the executive team in its assessment, agenda-setting and strategic initiatives. Established processes for performance and risk assessments are in place and are informed by experts from within and outside the organization, as well as by the executive team.

We are committed to communicating with transparency and reporting annually in our Sustainability Report in line with the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD) guidelines.

In 2023, the Company continued to make significant strides in our sustainability efforts:

| · | We achieved our lowest GHG emissions intensity since becoming an independent exploration and production company in 2013, and are on track to achieve 15-20% reduction by 2030 (from 2019 baseline) |

| · | We are on track to achieve zero routine flaring by 2030 |

| · | We achieved our lowest methane emissions intensity |

| · | We continued to secure third-party assurance of our Scope 1 and 2 GHG emissions, and to report our estimated Scope 3, Category 11 – Use of Sold Products emissions |

| · | We continued to publish our TCFD climate-related scenario analysis, including a net zero emissions by 2050 scenario |

| · | We achieved our second highest water recycling ratio in Company history |

Note: Unless otherwise specified, the information provided is at the total enterprise level, for assets under our operational control and for calendar year 2023

ii MURPHY OIL CORPORATION

| Health, Safety & Environment | ||||

Charles H. Murphy, Jr. was a forerunner in the environmental awareness movement. His efforts helped lead to new standards and practices for the oil and natural gas industry and we strive to do the same today.

We established a Health, Safety and Environmental Committee of the Board of Directors in 1993 |

| · | Our worldwide Health, Safety and Environment Management System applies to every Murphy employee, contractor and partner |

| · | Safety metrics, including both employees and contractors, have been included in annual incentive plan performance metrics since 2008 |

| · | Environmental metrics have been included in annual incentive plan performance metrics since 2016 |

| · | We are a founding member of the API Environmental Partnership, launched in 2017, which is focused on reducing methane emissions |

| · | We strive to achieve top-quartile safety performance as measured against our peers. In 2023, we had zero work-related fatalities |

We monitor environmental performance and strive for continual improvement:

| · | Continuing to de-risk our assets through implementation of our detailed Asset Integrity Management Programs |

| · | Continuing to eliminate natural gas pneumatic instruments |

| · | Upgrading central processing facilities to add electric motor driven tank Vapor Recovery Units (VRUs) to eliminate continuous tank flaring |

| · | Adding natural gas pipeline infrastructure to legacy and future Murphy onshore developments to eliminate flaring and venting |

| · | Continuing to internally report GHG and methane emissions performance metrics monthly to increase visibility to operations and management |

| Our Communities |

Working with Communities

| · | We communicate with community stakeholders to understand issues applicable to our operations and to mitigate potential risks |

| · | Opportunities to support local communities through: |

| - | Prioritization of local suppliers |

| - | Threshold investment targets for local content |

| - | Specifications for local companies or workers |

| - | Commitments to social investment programs |

| · | We actively seek to understand and respond to community feedback, concerns or grievances |

Committed to the Dignity and Rights of All People

| · | We have enacted a Human Rights Policy, Indigenous Rights Policy and Supplier Code of Conduct |

Investing in Our Communities

| · | Long time commitment with the El Dorado Promise Scholarship Program – through a $50 million commitment from the Company, more than 3,500 El Dorado, Arkansas students have received scholarships to 181 colleges and universities in 40 states |

| · | Numerous corporate citizenship programs, with Murphy employees enthusiastically volunteering their time and generously donating to their communities. In 2023, our employees’ exceptional voluntary contributions were honored with the United States President’s Volunteer Service Award by the Houston Food Bank for the second consecutive year. Additionally, the Spring Branch Independent School District in Houston recognized our commitment with their esteemed Good Neighbor Award |

| · | Also, in 2023, Murphy donated approximately $200,000 through its gift matching program for employees and non-employee directors. Over the last 20 years, Murphy and its employees contributed more than $15 million to benefit the United Way organization |

2024 PROXY STATEMENT iii

Murphy Oil at a Glance

Our 2023 Financial and Operational Highlights

Murphy closed another year of strong production and excellent execution in 2023 with the priorities of Delever, Execute, Explore, Return remaining at the forefront. By achieving our $500 million debt reduction goal for the year, we have fortified our balance sheet by reducing total debt by $1.7 billion since 2020. This has provided further strength to our longstanding quarterly dividend, which was increased in early 2024 to the 2016 level of $1.20 per share annualized, as well as initiating share repurchases in 2023 with $150 million, or 3.4 million, shares repurchased.

This debt reduction was accomplished through the successful execution of Murphy’s onshore well delivery program during the year, as well as steady operational achievements of above-forecast production offshore. Also in 2023, we extended our portfolio longevity with the sanctioning of the Lac Da Vang field development project in Vietnam. As a result of the team’s efforts, Murphy achieved total reserve replacement of 139% for the year.

Reviewing our exploration portfolio, Murphy was awarded five exploration blocks in the March 2023 Gulf of Mexico federal lease sale and named apparent high bidder on eight exploration blocks in the December 2023 federal lease sale. The Company also acquired working interests in the non-operated Zephyrus discovery in the Gulf of Mexico, as well as signed production sharing contracts on five exploration blocks in Côte d’Ivoire, including one block that holds a previous operator’s discovery. Murphy’s plans in 2024 include drilling exploration wells in the Gulf of Mexico and Vietnam, as well as advancing seismic reprocessing projects in the Gulf of Mexico and Côte d’Ivoire.

With our 2024 debt reduction goal of $300 million, we are on track to reach Murphy 3.0 of the capital allocation framework by year-end, with up to 50% of adjusted free cash flow1 allocated to the balance sheet and the remaining 50% of adjusted free cash flow1 allocated to shareholder returns. Shareholder returns remain at the forefront, and ongoing debt reduction has substantially improved the Company’s resiliency in this cyclical commodity business. Pairing balance sheet strength and operational excellence with a strong safety culture and an ongoing focus on protecting the environment, Murphy is positioned for long-term stability and success.

Highlights for 2023:

Delever

| · | Utilized proceeds from non-core divestiture to progress capital allocation framework |

| · | Achieved $500 MM debt reduction goal through senior notes redemption and partial tender |

| · | Advanced Murphy 2.0 of capital allocation framework with $1.7 BN of total debt reduction since year-end 2020 |

Execute

| · | Produced 186 MBOEPD with 98 MBOPD, or 52 percent, oil volumes |

| · | Initiated procurement for Lac Da Vang field development project in Vietnam with first oil forecast in 2026 |

| · | Acquired 8 percent working interest in the non-operated Zephyrus discovery in the Gulf of Mexico for $13 MM after closing adjustments |

| · | Achieved 139% total reserve replacement with 724 MMBOE proved reserves and ~11-year reserve life |

Explore

| · | Initiated new exploration focus area in Côte d’Ivoire |

| · | Drilled a discovery at operated Longclaw #1 exploration well in Gulf of Mexico |

| · | Awarded five exploration blocks in Gulf of Mexico Federal Lease Sale 259 and named apparent high bidder on eight exploration blocks in Gulf of Mexico Federal Lease Sale 261 |

Return

| · | Progressed Murphy 2.0 of capital allocation framework, with 75% of adjusted FCF1 allocated to debt reduction and 25% allocated to shareholder returns |

| · | Repurchased $150 MM, or 3.4 MM shares, at an average price of $43.96 / share in FY 2023 |

| 1 | Adjusted free cash flow is calculated as net cash provided by continuing operations activities before noncash working capital changes, less property additions and dry hole costs, acquisition of oil and natural gas properties, cash dividends paid, distributions to noncontrolling interest and other contractual payments |

iv MURPHY OIL CORPORATION

Financial

$1.7 BN Approximate net cash provided by continuing operations activities (including noncontrolling interest)

of free cash flow2,3, with the majority used to repay long-term debt, fund accretive acquisitions, increase longstanding dividend and

|

When and where is the Annual Meeting?

The Company’s 61st Annual Meeting will be held at 10:00 a.m. CDT on Wednesday, May 9, 2018, at the South Arkansas Arts Center, located at 110 East 5th Street, in El Dorado, Arkansas 71730.

May I attend the meeting?

Attendance at the meeting is open to stockholders of record as of March 12, 2018, Company employees and certain guests. If you are a stockholder, regardless of the number of shares you hold, you may attend the meeting.

Who may vote?

You may vote if you were a holder of record of Murphy Oil Corporation common stock as of the close of business on March 12, 2018. Each share of common stock is entitled to one vote at the Annual Meeting. You may vote in person at the meeting, or by proxy via the methods explained on page 1 of this document.

Why should I vote?

Your vote is very important regardless of the amount of stock you hold. The Board strongly encourages you to exercise your right to vote as a stockholder of the Company.

Why did I receive a Notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

We are providing access to our proxy materials via the internet. As a result, we have sent a Notice of Internet Availability instead of a paper copy of the proxy materials to most of our stockholders. The Notice contains instructions on how to access the proxy materials via the internet and how to request a paper copy. In addition, the website provided in the Notice allows stockholders to request future proxy materials in printed form by mail or electronically by email. A stockholder’s election to receive proxy materials by mail or email will remain in effect until the stockholder terminates it.

Why didn’t I receive a Notice in the mail regarding the internet availability of proxy materials?

We are providing certain stockholders, including those who have previously requested paper copies of the proxy materials, with paper copies of the proxy materials instead of a Notice. If you would like to reduce the costs incurred by Murphy in mailing proxy materials and conserve natural resources, you can consent to receive all future proxy statements, proxy cards and annual reports electronically via email. To sign up for electronic delivery, please follow the instructions provided with your proxy materials and on your proxy card or voting instruction card. When prompted, indicate that you agree to receive or access stockholder communications electronically in the future.

May I vote my stock by filling out and returning the Notice?

No. Instructions on how to access the proxy materials and vote are in the email sent to you and on the Notice.

How can I access the proxy materials through the internet?

Your Notice or proxy card will contain instructions on how to view our proxy materials for the Annual Meeting via the internet. The Proxy Statement and Annual Report are also available athttp://ir.murphyoilcorp.com/phoenix.zhtml?c=61237&p=proxy.Operations

186,000 barrels of oil equivalent per day produced with ~98 thousand barrels of oil per day 724 MM barrels of oil equivalent of proved reserves, with 139% total reserve replacement and a reserve life index of approximately 11 years |

Onshore

Eagle Ford Shale

Eagle Ford Shale

Continued realizing strong performance with wells producing at or above forecast | |||

Tupper Montney

Tupper Montney

| · | Continued realizing strong well performance with modifications to flowback, facility and wellhead equipment, and procedures |

| · | Achieved some of highest 30-day initial production (IP30) rates in Company history |

Exploration

Côte d’Ivoire

Côte d’Ivoire

| · | Signed production sharing contracts for five exploration blocks |

| · | Includes undeveloped Paon discovery |

U.S. Gulf of Mexico

U.S. Gulf of Mexico

| · | Maintained high uptime across operated assets with safe operations and strong environmental performance |

Offshore Canada

Offshore Canada

| · |

|

Vietnam

Vietnam

| · | Sanctioned the Lac Da Vang field development project, with first oil forecast in 2026 |

| 2 | Free cash flow is calculated as net cash provided by continuing operations activities (including noncontrolling interest) and before noncash working capital changes, less property additions and dry hole costs |

| 3 |

See Annex for reconciliations of non-GAAP financial measures to their most closely comparable GAAP metric |

2024 PROXY STATEMENT v

The affirmative vote of

Murphy Oil at a majorityGlance

Note: Unless otherwise noted, the financial and operating highlights and metrics discussed above exclude noncontrolling interest, thereby representing only the amounts attributable to Murphy

Forward-Looking Statements and Risks

This report contains forward-looking statements within the meaning of the shares presentPrivate Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified through the inclusion of words such as “aim,” “anticipate,” “believe,” “drive,” “estimate,” “expect,” “expressed confidence,” “forecast,” “future,” “goal,” “guidance,” “intend,” “may,” “objective,” “outlook,” “plan,” “position,” “potential,” “project,” “seek,” “should,” “strategy,” “target,” “will” or variations of such words and other similar expressions. These statements, which express management’s current views concerning future events, results and plans, are subject to inherent risks, uncertainties and assumptions (many of which are beyond our control) and are not guarantees of performance. In particular, statements, express or implied, concerning the Company’s future operating results or activities and returns or the Company’s ability and decisions to replace or increase reserves, increase production, generate returns and rates of return, replace or increase drilling locations, reduce or otherwise control operating costs and expenditures, generate cash flows, pay down or refinance indebtedness, achieve, reach or otherwise meet initiatives, plans, goals, ambitions or targets with respect to emissions, safety matters or other ESG (environmental/social/governance) matters, make capital expenditures or pay and/or increase dividends or make share repurchases and other capital allocation decisions are forward-looking statements. Factors that could cause one or more of these future events, results or plans not to occur as implied by any forward-looking statement, which consequently could cause actual results or activities to differ materially from the expectations expressed or implied by such forward-looking statements, include, but are not limited to: macro conditions in personthe oil and gas industry, including supply/demand levels, actions taken by major oil exporters and the resulting impacts on commodity prices; geopolitical concerns; increased volatility or representeddeterioration in the success rate of our exploration programs or in our ability to maintain production rates and replace reserves; reduced customer demand for our products due to environmental, regulatory, technological or other reasons; adverse foreign exchange movements; political and regulatory instability in the markets where we do business; the impact on our operations or market of health pandemics such as COVID-19 and related government responses; other natural hazards impacting our operations or markets; any other deterioration in our business, markets or prospects; any failure to obtain necessary regulatory approvals; any inability to service or refinance our outstanding debt or to access debt markets at acceptable prices; or adverse developments in the U.S. or global capital markets, credit markets, banking system or economies in general, including inflation. For further discussion of factors that could cause one or more of these future events or results not to occur as implied by proxy at theany forward-looking statement, see Item 1A. Risk Factors in our most recent Annual Meeting is required for approval of matters presented at the meeting. Your proxy will be voted at the meeting unless you (i) revoke it at any time before the vote by filing a revocationReport on Form 10-K filed with the Corporate SecretaryU.S. Securities and Exchange Commission (“SEC”) and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K that we file, available from the SEC’s website and from Murphy Oil Corporation’s website at http://ir.murphyoilcorp.com. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the investors page of our website. We may use these channels to distribute material information about the Company, (ii) duly execute a proxy card bearing a later date or (iii) appear atCompany; therefore, we encourage investors, the meetingmedia, business partners and voteothers interested in person. If you voted via the Internet, mobile device or telephone, you can change your vote with a timely and valid later vote or by voting by ballot at the meeting. Proxies returned to the Company, votes cast other than in person and written revocations will be disqualified if received after commencement of the meeting. If you elect to vote your proxy card or as directed on the Notice or vote by telephone, mobile device or internet as described in the telephone/mobile device/internet voting instructions on your proxy card or Notice, the Company will vote your shares as you direct. Your telephone/mobile device/internet vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed and returned your proxy card.

Votes cast by proxy or in person at the meeting will be counted by the persons appointed by the Company to act as Judgesreview the information we post on our website. The information on our website is not part of, Election for the meeting. and is not incorporated into, this report. Murphy Oil Corporation undertakes no duty to publicly update or revise any forward-looking statements.

vi MURPHY OIL CORPORATION

Table of Contents

| 1 | ||||

| 2 | ||||

| 7 | ||||

| 10 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 22 | ||||

| 29 | ||||

| 30 | ||||

| Compensation Committee Report | 31 | |||

| Executive Compensation | 32 | |||

| Our Stockholders | 41 | |||

| 44 | ||||

Approval of Appointment of IndependentRegistered Public Accounting Firm | 45 | |||

| 47 | ||||

| 48 | ||||

| 51 | ||||

The Judgessolicitation of Election will treat shares represented by proxies that reflect abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum. Abstentions do not constitute a vote “against” any matter. However, in accordance with NYSE rules, abstentions will have the effect of a vote counted “against” for our plans.

The Judges of Election will treat shares referred to as “brokernon-votes” (i.e., shares held by brokers or nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote and that the broker or nominee does not have discretionary power to vote on as anon-routine matter) as shares that are present and entitled to vote on routine matters and for purposes of determining the presence of a quorum. The proposal to approve the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the current fiscal year should be considered a routine matter. However, for purposes of determining the outcome of anynon-routine matter as to which the broker does not have discretionary authority to vote, those shares will be treated as not present and not entitled to vote with respect to that matter (even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other matters). Accordingly, brokernon-votes will be disregarded in the calculation of “votes cast” and will have no effect on the vote. Notably, the election of directors, the advisory vote to approve executive compensation, the approval of the proposed 2018 Stock Plan forNon-Employee Directors and the approval of the proposed 2018 Long-Term Incentive Plan should be considerednon-routine matters.

Unless specification to the contrary is made, the shares represented by the enclosed proxy will be voted FOR all the nominees for director, FOR the approval of the compensation of the Company’s Named Executive Officers, FOR the approval of the proposed 2018 Stock Plan forNon-Employee Directors, FOR the approval of the proposed 2018 Long-Term Incentive Plan and FOR the approval of the action of the Audit Committeeis made on behalf of the Board of Directors in appointing KPMG LLP asof Murphy Oil Corporation (the “Board”) for use at the Annual Meeting of Stockholders to be held on May 8, 2024. It is expected that this Proxy Statement and related materials will first be provided to stockholders on or about March 21, 2024. The complete mailing address of the Company’s independent registered public accounting firm for 2018.principal executive office is 9805 Katy Freeway, G-200, Houston, Texas 77024. References in this Proxy Statement to “we,” “us,” “our,” “the Company”, “Murphy Oil” and “Murphy” refer to Murphy Oil Corporation and its consolidated subsidiaries.

The expenses of printing and distributing proxy material, including expenses involved in forwarding materials to beneficial owners of stock, will be paid by the Company. The Company’s officers or employees, without additional compensation, may solicit the return of proxies from certain stockholders by telephone or other means.

2024 PROXY STATEMENT vii

2024 PROXY STATEMENT 1

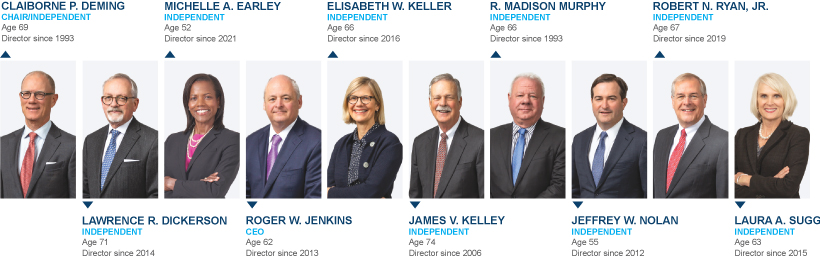

Who We Are

On March 12, 2018, the record date for the meeting, the Company had 173,036,510 shares of Common Stock outstanding, all of one class and each share having one vote with respect to all matters to be voted on at the meeting. This amount does not include 22,027,336 shares of treasury stock. Information as to Common Stock ownership of certain beneficial owners and management is set forth in the tables on pages 15 and 16 (“Security Ownership of Certain Beneficial Owners” and “Security Ownership of Management”).

2 MURPHY OIL CORPORATION

MICHELLE A. EARLEY Austin, Texas Age: 52 Director Since: 2021 | Board Committees · Finance · Health, Safety, Environment and Corporate Responsibility Other Public Company Directorships · Adams Resources & Energy, Inc., Houston, Texas Principal occupation or employment · Partner, O’Melveny & Meyers LLP, an international law firm, since April 2022 · Partner, Locke Lord LLP, from 2008 to April 2022 | Ms. Earley is currently a Partner at the law firm of O’Melveny & Meyers LLP, having joined the firm in April 2022. Ms. Earley was previously with the law firm of Locke Lord LLP, where she joined in 1998 and served as a Partner from 2008 until 2022. Ms. Earley has extensive experience in mergers and acquisitions, as well as securities regulation and offering matters and routinely advises boards of directors on corporate governance topics. She brings to the Board expertise in legal matters and corporate governance. She holds a bachelor’s degree from Texas A&M University and a law degree from Yale University. | ||||||||||||||

ROGER W. JENKINS Houston, Texas Age: 62 Director Since: 2013 | Board Committees · None Other Public Company Directorships · Noble Corporation plc, London, United Kingdom, until February 2021 Principal occupation or employment · Chief Executive Officer of the Company from August 2013; President of the Company from August 2013 through January 2024; President of Murphy Exploration & Production Company since June 2012 | Mr. Jenkins’ leadership as Chief Executive Officer of Murphy Oil Corporation allows him to provide the Board with his detailed perspective of the Company’s global operations. With a bachelor’s degree in Petroleum Engineering, a master’s degree in Business Administration and approximately 41 years of industry experience, he has played a critical leadership role in Murphy’s worldwide exploration and production operations, including the development of the Kikeh field in Malaysia and the Eagle Ford Shale in Texas. | ||||||||||||||

2024 PROXY STATEMENT 3

Who We Are

ELISABETH W. KELLER Cambridge, Massachusetts Age: 66 Director Since: 2016 | Board Committees · Audit · Health, Safety, Environment and Corporate Responsibility (Chair) · Nominating and Governance Other Public Company Directorships · None Principal occupation or employment · President, Inglewood Plantation, LLC, from 2014 to 2022, retired December 2022 | Ms. Keller served as the President of Inglewood Plantation, LLC and was responsible for the development of strategic vision and oversight of operations for the largest organic farm in Louisiana. She brings to the Board extensive knowledge in health and environmental issues, both domestically and internationally. | ||||||||||||||

JAMES V. KELLEY Little Rock, Arkansas Age: 74 Director Since: 2006 | Board Committees · Audit · Nominating and Governance (Chair) Other Public Company Directorships · None Principal occupation or employment · Retired, President and Chief Operating Officer, BancorpSouth, Inc., a NYSE bank holding company, since August 2014 | Mr. Kelley has extensive knowledge of capital markets and accounting issues. As former President and Chief Operating Officer of BancorpSouth, Inc., he understands the fundamentals and responsibilities of operating a large company. Among other qualifications, Mr. Kelley brings to the Board experience in banking, finance and accounting, as well as executive management. | ||||||||||||||

4 MURPHY OIL CORPORATION

R. MADISON MURPHY El Dorado, Arkansas Age: 66 Director Since: 1993 (Chair, 1994-2002) | Board Committees · Finance (Chair) · Health, Safety, Environment and Corporate Responsibility Other Public Company Directorships · Murphy USA Inc. (Chair), El Dorado, Arkansas Principal occupation or employment · President, The Murphy Foundation · Owner, The Sumac Company, LLC · Owner, Arc Vineyards · Owner, Presqu’ile Winery | Mr. Murphy served at Murphy Oil Corporation in several capacities from 1980 including as Vice President of Planning and Treasurer from 1988-1990; Chief Financial and Administrative Officer from 1990-1994; and Chair of the Board from 1994 to 2002. This background, along with his current membership on the Board of Directors of Murphy Oil and Chairmanship of Murphy USA, together with his past membership on the Board of Directors of BancorpSouth, Inc. (a NYSE bank holding company), and Deltic Timber Corporation, brings to the Board invaluable corporate leadership and financial expertise. | ||||||||||||||

JEFFREY W. NOLAN Little Rock, Arkansas Age: 55 Director Since: 2012 | Board Committees · Compensation · Finance · Nominating and Governance Other Public Company Directorships · None Principal occupation or employment · President and Chief Executive Officer, Loutre Land and Timber Company, a natural resources company with a focus on the acquisition, ownership and management of timberland and mineral properties, from 1998 until 2021, retired December 2021 · Chair of the Board of Directors, First Financial Bank, headquartered in EI Dorado, Arkansas, since 2015 | Mr. Nolan’s experience as President and Chief Executive Officer of a natural resources company, in addition to his former legal practice focused on business and corporate transactions, allows him to bring to the Board expertise in legal matters, corporate governance, corporate finance, acquisitions and divestitures and the management of mineral properties. | ||||||||||||||

2024 PROXY STATEMENT 5

Who We Are

Robert N. Ryan, Jr. Houston, Texas Age: 67 Director Since: 2019 | Board Committees · Audit · Compensation · Health, Safety, Environment and Corporate Responsibility Other Public Company Directorships · None Principal occupation or employment · Retired, Vice President, Chevron Corporation, an integrated energy company, since 2018 | Mr. Ryan has 43 years of experience in the energy industry including 15 years as Vice President - Global Exploration for Chevron from 2003 until his retirement in 2018. He brings to the Board extensive experience in worldwide exploration and portfolio management, and a broad knowledge of oil and natural gas operations and energy policy. His experience includes a position in the Office of Energy Efficiency and Renewable Energy at the U.S. Department of Energy. He holds degrees in geology. | ||||||||||||||

LAURA A. SUGG Montgomery, Texas Age: 63 Director Since: 2015 | Board Committees · Compensation (Chair) · Finance Other Public Company Directorships · Kinetik Holdings Inc., Houston, Texas · Public Service Enterprise Group Inc., Newark, New Jersey · Denbury Resources, Plano, Texas, until 2019 Principal occupation or employment · Retired, Senior Executive, ConocoPhillips, then an international, integrated energy company, since 2010 | Ms. Sugg’s broad background in capital allocation and accomplishments in the energy industry allow her to bring to the Board expertise in industry, operational and technical matters. Among other qualifications, she brings to the Board specific experience in executive leadership, human resources, compensation and financial matters. As a former leader at ConocoPhillips, Ms. Sugg has a proficient understanding of an oil and natural gas company’s challenges and opportunities. | ||||||||||||||

6 MURPHY OIL CORPORATION

How We Are Selected, Comprised and Evaluated

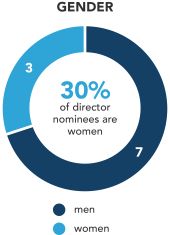

Diversity

The Board recognizes thatbelieves it is important for the Company’s directors to possess a diverse array of attributes, backgrounds, perspectives, skills, and skills, whether in terms of executive management leadership or educational achievement.achievements. When considering new candidates, the Nominating &and Governance Committee, with input from the Board, adopts criteria for Board membership which encourages a diversity of race, ethnicity, gender and national origin and takes into account these factors as well as other appropriateimportant characteristics, such as sound judgment, honesty,professional ethics, practical wisdom and integrity. In addition, theThe Nominating &and Governance Committee, when searching for nominees for directors, relies onincludes diverse candidates in the pool of nominees and any search firm engaged by the Committee is affirmatively instructed to seek diverse candidates. In addition, as stated in the Company’s Corporate Governance Guidelines, which state, “The“the Company endeavors to have a board representing diverse experience at the policy-making levels in business areas that are relevant to the Company’s global activities.”activities”. The goal is to assemble and maintain a Board comprised of individuals that not only bring to bear a wealth of business and/or technical expertise, but that also demonstrate a commitment to ethics in carrying out the Board’s responsibilities with respect to oversight of the Company’s operations.

The matrix below outlines the diverse set of skills and expertise represented on the Company’s Board:

SKILLS AND EXPERTISE | ||||||||||||||||||||||

EXPERIENCE |  |  |  |  |  |  |  |  |  |  | ||||||||||||

| Former CEO | ● | ● | ● | ● | ● | ||||||||||||||||

| Senior Management/Corporate Culture | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Accounting/Audit | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| Finance/Banking | ● | ● | ● | ● | ● | ||||||||||||||||

| Corporate Governance | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Law | ● | ● | ● | ||||||||||||||||||

| Government Relations/Public Policy | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| Industry | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Operations | ● | ● | ● | ● | ● | ||||||||||||||||

| Environment, Health & Safety | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Business Development & Corporate Strategy | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Human Capital/Compensation | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| Board of Directors | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||

| Risk Management | ● | ● | ● | ● | ● | ||||||||||||||||

| International Business | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Climate | ● | ● | ● | ||||||||||||||||||

| Cybersecurity | ● | ● | |||||||||||||||||||

2024 PROXY STATEMENT 7

| DEMOGRAPHICS | ||||||||||||||||||||||

|  |  |  |  |  |  |  |  |  | |||||||||||||

RACE/ETHNICITY | ||||||||||||||||||||||

African American | ● | |||||||||||||||||||||

Asian/Pacific Islander | ||||||||||||||||||||||

White/Caucasian | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

Hispanic/Latino | ||||||||||||||||||||||

Native American | ||||||||||||||||||||||

GENDER | ||||||||||||||||||||||

Male | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

Female | ● | ● | ● | |||||||||||||||||||

BOARD TENURE | ||||||||||||||||||||||

Years | 30 | 9 | 3 | 7 | 17 | 30 | 11 | 4 | 8 | 10 | ||||||||||||

Age | 69 | 71 | 52 | 66 | 74 | 66 | 55 | 67 | 63 | 62 | ||||||||||||

|  |  |

8 MURPHY OIL CORPORATION

Majority Voting

The Company’s belief in directors’ accountability is evident in the provision in our Corporate Governance Guidelines providing that an incumbent director who fails to receive a majority of votes cast for re-election shall tender a resignation to the Board. To the extent authorized by the proxies, the shares represented by the proxies will be voted in favor of the election of the twelveten nominees for director whose names are set forth herein. The Company’s Corporate Governance Guidelines provide that an incumbent director who fails to receive the required vote forre-election shall tender a resignation to the

board. If for any reason any of these nominees is not a candidate when the election occurs, the shares represented by such proxies will be voted for the election of the other nominees named and may be voted for any substituted nominees or the Board may reduce its size. However, management of the Company does not expect this to occur. All nominees were elected at the last Annual Meeting of Stockholders.

AllDirector and Nominee Independence

The Company’s belief in the importance of directors’ independence is reflected by the fact that all directors, other than Mr. Roger Jenkins, have been deemed independent by the Board based on the rules of the New York Stock Exchange (“NYSE”) and the standards of independence included in the Company’s Corporate Governance Guidelines. As part of its independence recommendation to the Board, the Nominating &and Governance Committee at its February meeting considered familial relationships (Mr. Deming, Mr. Murphy and Ms. Keller are first cousins).

Mr. Deming, the independent ChairmanChair of the Board, serves as presiding director at regularly scheduled board meetings as well as at no less than three meetings solely fornon-employee directors. The meetings fornon-employee directors are held in conjunction with the regularly scheduled February, August and December board meetings,meetings. If the Company had a non-employee director that was not independent, at least one of which includesthese meetings would include only independentnon-employee directors.

|

|

The Corporate Governance Guidelines provide that stockholders and other interested parties may send communications to the Board, specified individual directors and the independent directors as a group c/o the Corporate Secretary, Murphy Oil Corporation, P.O. Box 7000, El Dorado, Arkansas 71731-7000. All such communications will be kept confidential unless otherwise required by law and relayed to the specified director(s). The names of the Director nominees and certain information as to them, are as follows:

|

|

|

| |||||

| ||||||||

Mr. Collins has extensive knowledge of international management and corporate development. As a prior President and Chief Executive Officer of Oceaneering International, Inc., he has substantial knowledge and experience in the oil and gas industry. Among other qualifications, Mr. Collins brings to the Board experience in field operations, executive management and finance.

|

|

|

| |||||

| ||||||||

Mr. Cossé’s long service in several capacities with the Company has helped him gain a proficient understanding of many areas, including environmental laws and regulations. Among other qualifications, Mr. Cossé brings to the Board expertise in corporate governance, banking and securities laws and executive leadership.

|

|

|

| |||||

| ||||||||

Mr. Deming’s experience as former President and Chief Executive Officer of Murphy Oil Corporation gives him insight into the Company’s challenges, opportunities and operations. Among other qualifications, Mr. Deming brings to the Board executive leadership skills and over 30 years’ experience in the oil and gas industry.

|

|

|

|

|

| |||||

| ||||||||

Mr. Dickerson’s experience as the President and a director of Diamond Offshore Drilling, Inc. from March 1998 and as Chief Executive Officer from May 2008 until his retirement in March 2014 brings to the Board broad experience in leadership and financial matters. Among other qualifications, he brings to the Board expertise as a Certified Public Accountant and in international drilling operations.

|

|

|

| |||||

| ||||||||

Mr. Jenkins’ leadership as President and Chief Executive Officer of Murphy Oil Corporation allows him to provide the Board with his detailed perspective of the Company’s global operations. With a Bachelor’s degree in Petroleum Engineering, a Master’s degree in Business Administration and over 30 years of industry experience, he has played a critical leadership role in Murphy’s worldwide exploration and production operations, including the development of the Kikeh field in Malaysia and the Eagle Ford Shale in South Texas.

|

|

|

| |||||

| ||||||||

Ms. Keller is the President of Inglewood Plantation, LLC and is responsible for the development of strategic vision and oversight of operations of the largest organic farm in Louisiana. She brings to the Board extensive knowledge in health and environmental issues, both domestically and internationally.

|

|

|

|

|

| |||||

| ||||||||

Mr. Kelley has extensive knowledge of capital markets and accounting issues. As former President and Chief Operating Officer of BancorpSouth, Inc., he understands the fundamentals and responsibilities of operating a large company. Among other qualifications, Mr. Kelley brings to the Board experience in banking, finance and accounting, as well as executive management.

|

|

|

| |||||

| ||||||||

Mr. Mirosh, with his accomplishments in the chemical, natural gas, and investment industries, is able to provide the Board with dependable and insightful input in many areas. He brings to the Board experience in energy, regulatory and international law as well as skills in business development and corporate strategy.

|

|

|

| |||||

| ||||||||

Mr. Murphy served as Chairman of the Board of Murphy Oil Corporation from 1994 to 2002. This background, along with his previous membership on the Board of Directors of Deltic Timber Corporation and current membership on the Board of Directors of Murphy USA Inc., brings to the Board and to the Audit Committee a unique business and financial perspective.

|

|

|

|

|

| |||||

| ||||||||

Mr. Nolan’s experience as President and Chief Executive Officer of a natural resources company, in addition to his former legal practice focused on business and corporate transactions, allows him to bring to the Board expertise in legal matters, corporate governance, corporate finance, acquisitions and divestitures and the management of mineral properties.

|

|

|

| |||||

| ||||||||

Mr. Schmale, as former Chief Operating Officer of Sempra Energy, brings to the Board the perspective of a corporate leader having faced external economic, social and governance issues. He also brings specific experience in financial matters from his prior service as Chief Financial Officer of Sempra Energy. He holds degrees in petroleum engineering and law, and has a vast knowledge in different fields concerning the oil industry.

|

|

|

| |||||

| ||||||||

Ms. Sugg’s broad background in capital allocation and accomplishments in the energy industry allow her to bring to the Board expertise in industry, operational and technical matters. Among other qualifications, she brings to the Board specific experience in executive leadership, human resources, compensation and financial matters. As a former leader at ConocoPhillips, Ms. Sugg has a proficient understanding of an oil company’s challenges and opportunities.

|

|

Board of Directors Skills and Expertise Matrix

The matrix below represents the diverse set of skills and expertise represented on the Company’s Board:

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

COMPOSITION OF THE BOARD

|

|

2024 PROXY STATEMENT 9

How We Are Organized and Operate

BOARD LEADERSHIP STRUCTUREBoard Leadership Structure/Separate Chair and CEO Positions

The positions of ChairmanChair of the Board and the Chief Executive Officer of the Company are held by two individuals. Mr. Deming serves as the ChairmanChair of the Board as a non-executive andan independent director. Mr. Jenkins is the Company’s President and Chief Executive Officer. Along with the ChairmanChair of the Board of Directors and the Chief Executive Officer, other directors bring different perspectives and roles to the Company’s management, oversight, and strategic development. The Company’s directors bring experience and expertise from both inside and outside the companyCompany and industry, while the Chief Executive Officer is most familiar with the Company’s business and industry, and most capable of leading the execution of the Company’s strategy. The Board believes that separating the roles of ChairmanChair and Chief Executive Officer is currently in the best interest of stockholders because it provides the appropriate balance between strategy development and independent oversight of management. The Board will, however, maintaindoes not believe that its flexibility to make this determination at any given pointrole in time to provide appropriaterisk oversight has been affected by the Board’s leadership for the Company.structure.

RISK MANAGEMENTRisk Management

The Board exercises risk management oversight and control both directly and indirectly, the latter through various Board Committees. The Board regularly reviews information regarding the Company’s credit, liquidity, and operations, including the risks associated with each.related risks. Further, the Company provides continuing education to our Board on topics that assist in the execution of their duties, including ESG matters. The Executive Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements.arrangements and the Company’s key human capital management strategies. The Audit Committee is responsible for oversight of certain risks, including financial, riskscybersecurity, information security, and the ethical conduct of the Company’s business, including the steps the Company has taken to monitor and mitigate these risks. In addition, the Company maintains property and casualty insurance coverage that may cover damages caused as a result of a cybersecurity event. The Finance Committee works in concert with the Audit Committee on certain aspects of risk management, including hedging and foreign exchange exposure. The Nominating &and Governance Committee, in its role of assessing the overall corporate governance structure of the Company and reviewing and maintaining the Company’s corporate governance guidelines, manages risks associated with the independence of the Board and potential conflicts of

interest. The Health, Safety, & EnvironmentalEnvironment and Corporate Responsibility Committee oversees management of risks associated with environmental, health and safety issues. While each committeeCommittee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports and by management about the known risks to the strategy and the business of the Company.

COMMITTEESFor more information on Board and Managerial oversight of ESG-focused responsibilities, see section titled “Board and Managerial Oversight of ESG Topics” in our 2023 Sustainability Report at www.murphyoilcorp.com/sustainability-report.

Committees

The standing committeesCommittees of the Board are the Executive Committee, the Audit Committee, the Executive Compensation Committee, the Nominating & GovernanceFinance Committee, the Health, Safety, Environment and Corporate Responsibility Committee, and the Health, Safety & EnvironmentalNominating and Governance Committee.

The Executive Committee, in accordance with the Company’sby-laws, is vested with the authority to exercise certain functions of the Board when the Board is not in session. The Executive Committee is also in charge of all financial accounting, legal and general administrative affairs of the Company, subject to any limitations prescribed by theby-laws or by the Board.

The Audit Committeehas the sole authority to appoint or replace the Company’s independent registered public accounting firm, which reports directly to the Audit Committee. The Audit Committee also assists the Board with its oversight of the integrity of the Company’s financial statements, the independent registered public accounting firm’s qualifications, independence and performance, the performance of the Company’s internal audit function, the compliance by the Company with legal and regulatory requirements, and the review of programs related to risk oversight, including cybersecurity, and compliance with the Company’s Code of Business Conduct and Ethics.

The Audit Committee meets with representatives of the independent registered public accounting firm and with members of the internal audit function for these purposes. TheIn February 2023, the Board has designated Neal E. SchmaleMr. Dickerson as its “Audit Committee Financial Expert” as defined in Item 407 ofRegulation S-K.

All of the members of the Audit Committee including Mr. Schmale are independent under the rules of the NYSE and the Company’s independence standards.

The Executive Compensation Committeeoversees the compensation of the Company’s executives and directors, and administers the Company’s annual incentive compensation plan, the long-term incentive plan and the stock plan fornon-employee directors. directors, administers the Company’s Compensation

10 MURPHY OIL CORPORATION

Recoupment Policy, and reviews the Company’s key human capital management strategies. The Compensation Discussion and Analysis section contains additional information about the Compensation Committee. In carrying out its duties, the Compensation Committee will have direct access independent compensation consultants to assist them.

All of the members of the Executive Compensation Committee are independent under the rules of the NYSE and the Company’s independence standards.

The Compensation Discussion and Analysis section contains additional information about the Executive Compensation Committee. In carrying out its duties, the Executive CompensationFinance Committee will have direct access to outside advisors, independent compensation consultants and others to assist them.

The Nominating & Governance Committee identifies and recommends potential Board members, recommends appointments to Board committees, oversees evaluation of the Board’s performance and reviews and assesses the Corporate Governance Guidelines of the Company. All of the members of the Nominating & Governance Committee are independent under the rules of the NYSE and the Company’s independence standards. Information regarding the process for evaluating and selecting potential director candidates, including those recommended by stockholders, is set out in the Company’s Corporate Governance Guidelines.

|

|

Stockholders desiring to recommend candidates for membership on the Board for consideration by the Nominating & Governance Committee should address their recommendations to: Nominating & Governance Committee of assists the Board of Directors c/o Corporate Secretary, Murphy Oil Corporation, P.O. Box 7000, El Dorado, Arkansas 71731-7000. As a matteron matters relating to the financial strategy, liquidity position and financial policies and activities of policy, candidates recommended by stockholders are evaluatedthe Company. In addition, the Finance Committee reviews and makes recommendations with respect to the Company’s capital structure, major capital projects and any dividend or share repurchase programs. The Finance Committee also works in consultation with the Audit Committee on the same basis as candidates recommended by Board members, executive search firms or other sources.Company’s risk management strategy, including hedging and foreign exchange exposure.

The Health, Safety, & Environmental Environment and Corporate Responsibility Committeeassists the Board and management in monitoring compliance with applicable environmental, health and safety laws, rules and regulations as well as the Company’s Worldwide Health, Safety & Environmental Policy. Review of policies, proceduresresponse to laws and practices regarding securityregulations as part of the Company’s peoplebusiness strategy and property is also within the purview of this committee.operations. The Committee assists the Board on matters relating to the Company’s response to evolving public issues affecting the Company in the realm of health, safety, and the environment. Consideration of evolving matters regarding the climate, responsible business conduct, the community, and review of the Company’s sustainability reports and other ESG issues that could affect the Company’s business activities is also within the purview of this Committee. To supplement the expertise of the Committee (as well as the full Board) and assist the Committee in the discharge of its duties, the Company regularly brings in outside subject matter experts and also continuously briefs the Committee on current and developing issues relevant to the Company’s business. The Committee has benefittedbenefited from the Company’s involvement with groups such as the AmericanInternational Petroleum Institute (API)Industry Environmental Conservation Association (Ipieca) and sponsorship of initiatives like the Massachusetts Institute of Technology’s Joint Program on the Science and Policy of Global Change, which keeps abreast of emerging issues with respect to climate change.

ChartersThe Nominating and Governance Committee identifies and recommends potential Board members, recommends to the Board the slate of directors nominated for selection at the Audit, Executive Compensation,annual meeting, recommends appointments to Board Committees, oversees evaluation of the Board’s performance, and assesses and makes recommendations concerning the overall corporate governance structure of the Company, including proposed changes to the Corporate Governance Guidelines of the Company. The Committee also oversees the Company’s lobbying activities

and political spending, and reviews current and emerging governance trends, issues and concerns that may affect the Company’s business, operations, performance, or reputation. All of the members of the Nominating &and Governance Committee are independent under the rules of the NYSE and Health, Safety & Environmental Committees,the Company’s independence standards.

Information regarding the process for evaluating and selecting potential director candidates, including those recommended by stockholders, is set out in the Committee’s Charter and in the Company’s Corporate Governance Guidelines. Stockholders desiring to recommend Board candidates for consideration by the Nominating and Governance Committee should address their recommendations to: Nominating and Governance Committee of the Board of Directors, c/o Corporate Secretary, Murphy Oil Corporation, 9805 Katy Freeway, G-200, Houston, Texas 77024. As a matter of policy, candidates recommended by stockholders are evaluated on the same basis as candidates recommended by Board members, executive search firms or other sources.

Committee Charters

All Committee Charters, along with the Corporate Governance Guidelines, Code of Business Conduct and Ethics and the Code of Ethical Conduct for Executive Management, are available on the Company’s website,http:website: https://ir.murphyoilcorp.com/phoenix.zhtml?c=61237&p=irol-govHighlights.corporate-governance/governance-documents. The information on the website is not deemed part of this proxy statement and is not incorporated by reference.

BOARD AND COMMITTEE EVALUATIONS

The Board and Committee Evaluations

Our Board of Directors recognizes that a thorough evaluation process is an important element of corporate governance and enhances our Board’s effectiveness. Therefore, each committee conducts an annual self-evaluation. Each November,year, the Chair of the Board and the Chair of each Board Committee request that the directors are requested to provide their assessmentsassessment of the effectiveness of the full Board and each of the committees on which they serve. The Corporate Secretary is instructed by each Chair to manage the distribution and collection of the individual assessmentsassessment forms which is conducted electronically through a third-party vendor portal. Once each director submits the completed assessment(s) through the portal, the responses are organized and summarized by the Corporate Secretary and provided to each ChairmanChair for review and discussion withat the next scheduled meeting during executive session.

It should be noted that the Board and each Board Committee reviews the committees.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2017, noneadequacy of its own performance through self-evaluation, but the Nominating and Governance Committee is charged with evaluating the adequacy of the membersentire process. Thus, each year, the Nominating and Governance Committee reviews and determines if the assessment forms stimulate a thoughtful evaluation about the Board and each Committee’s function and provides a forum for feedback on areas of the Executive Compensation Committee (i) was an officer or employee of the Company, (ii) was a former officer of the Company or (iii) had any relationship requiring disclosure by the Company under any paragraph of Item 404 of RegulationS-K.

improvement.

2024 PROXY STATEMENT 11

Meetings and Attendance

|

|

MEETINGS AND ATTENDANCE

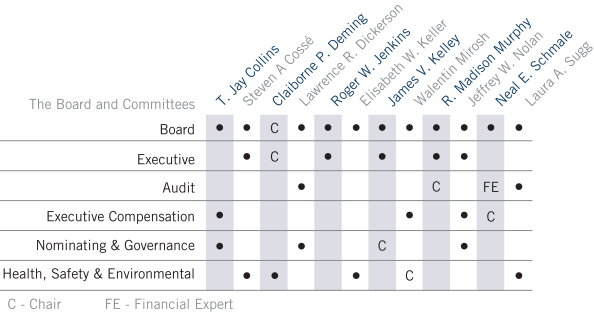

During 2017,2023, there were six meetings of the Board, eleven meetings of the Executive Committee, sixfive meetings of the Audit Committee, threefive meetings of the Executive Compensation Committee, threefour meetings of the Finance Committee, two meetings of the Nominating &and Governance Committee and twothree meetings of the Health, Safety, & EnvironmentalEnvironment and Corporate Responsibility Committee. All nominees’ attendance substantially exceeded 75% of the total number of meetings of the Board and committees on which they served. Attendance for Board and committee meetings averaged 99% for the full year. All the Board members attended the 20172023 Annual Meeting of Stockholders. As set forth in the Company’s Corporate Governance Guidelines, all Board members are expected to attend each Annual Meeting of Stockholders.

| The Board and Committees | ||||||||||||

| Audit | Compensation | Finance | Health, Safety, Environment and Corporate Responsibility | Nominating and Governance | ||||||||

Claiborne P. Deming | ||||||||||||

Lawrence R. Dickerson | C | M | ||||||||||

Michelle A. Earley | M | M | ||||||||||

Roger W. Jenkins | ||||||||||||

Elisabeth W. Keller | M | C | M | |||||||||

James V. Kelley | M | C | ||||||||||

R. Madison Murphy | C | M | ||||||||||

Jeffrey W. Nolan | M | M | M | |||||||||

Robert N. Ryan, Jr. | M | M | M | |||||||||

Laura A. Sugg | | |||||||||||

| M |

C = Chair M = Member  = Audit Committee Financial Expert

= Audit Committee Financial Expert

12 MURPHY OIL CORPORATION

How We Are Compensated

The Company’s standard arrangement for the compensation of non-employee directors divides remuneration into cash and equity components. This approach aligns the interests of directors and the stockholders they represent. The Company further targets total director compensation at a level near the 50th percentile of the competitive market (as determined by the Executiveour Compensation Committee’sCommittee (the “Committee”) together with its independent compensation consultant, Pay GovernanceMeridian Compensation Partners LLC (“Pay Governance”)Meridian”), enhancing the Company’s ability to retain and recruit qualified individuals.

Directors can elect to defer their cash compensation into the Company’sNon-Qualified Deferred Compensation Plan forNon-Employee Directors (“NED DCP Plan”) which was approved by the Board of Directors on February 1, 2017.. Deferred amounts are deemed to be notionally invested through a fund in the Company’s Stock Fund.stock. The column below showing “Fees Earned or Paid in Cash” column in the 2023 Director Compensation Table on the next page includes any amounts that were voluntarily deferred tointo the NED DCP Plan. Mr. Mirosh (Canadian citizen) does not have the opportunityIn addition, beginning with cash compensation to deferbe paid in 2024, Directors can elect to receive their cash compensation in this manner.the form of deferred restricted stock units, which settle either on (1) termination of service from the Board or (2) a future date selected by the director at the time of their deferral election.

In 2017,For 2023, the cash component consisted of an annual retainer of $60,000, plus $2,000 for each Board or committee meeting attended.$85,000. Supplemental retainers were paid to the ChairmanChair of the Board ($115,000)140,000), Audit Committee ChairmanChair ($15,000)20,000), the Audit Committee Financial Expert ($10,000)7,000), other members of the Audit Committee ($7,500)5,000),

Finance Committee Chair ($20,000), other members of the Executive CompensationFinance Committee Chairman ($15,000)5,000), and the Chair of each other committee ($10,000)15,000). Further, in early 2023, the Board established an ad hoc committee to assist the Board in its review of key

strategic topics, including the Company’s capital structure, competitor analysis, and energy strategy. The committee met three times in 2023. The Chair of the committee, Mr. Ryan, was awarded a supplemental retainer of $15,000 for his service during this period. The Company also reimburses directors for reasonable travel, lodging and related expenses they incur in attending Board and committee meetings.

In 2017, Also, in 2023, the total equity compensation fornon-employee directors was increased tomaintained at a grant date fair value of $200,000 to bringkeep the total director compensation to a level near the 50th50th percentile of the Company’s peer group, (as determined by the Pay Governance) enhancing the Company’s ability to retain and recruit qualified individuals. Eachnon-employee director received 6,9354,740 time-based restricted stock units on February 1, 2017,2, 2023, which cliff vest after three years.one year.

Pursuant to the 2021 Stock Plan for Non-Employee Directors and the applicable award agreements thereunder, directors can elect to defer settlement of their restricted stock units. In 2023, Mr. Dickerson, Ms. Earley, Mr. Nolan and Ms. Sugg elected to defer settlement of their restricted stock units to either (1) termination of service from the Board or (2) on a future date selected by the director at the time of their deferral election.

Thenon-employee directors are eligible to participate in the matching charitable gift program on the same terms as U.S.-based Murphy employees. Under this program, an eligible person’s total charitable gifts of up to $12,500$7,500 per calendar year will qualify. The Company will contribute to qualified educational institutions and hospitals an amount equal to twice the amount (2 to 1) contributed by the eligible person. The Company will contributematch contributions to qualified welfare and cultural organizations an amount equal to (1 to 1) the contribution made by the eligible person. Those amounts are in the column below showing “All Other Compensation”.

2017 DIRECTOR COMPENSATION TABLE

2024 PROXY STATEMENT 13

Name

| Fees Earned or ($)

| Stock

| Option

| Non-Equity

|

Change in Nonqualified

| All Other

| Total ($)

| |||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 Director Compensation Table | 2023 Director Compensation Table | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fees Earned or Paid in Cash ($) | Stock Awards1,2 ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings3 ($) | All Other Compensation4 ($) | Total ($) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Claiborne P. Deming | 219,017 | 200,006 | — | — | — | — | 419,023 | |||||||||||||||||||||||||||||||||||||||||||||||||

T. Jay Collins | 84,017 | 200,006 | — | — | — | — | 284,023 | |||||||||||||||||||||||||||||||||||||||||||||||||

Steven A. Cossé | 98,017 | 200,006 | — | — | — | 24,500 | 322,523 | |||||||||||||||||||||||||||||||||||||||||||||||||

Claiborne P. Deming | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Claiborne P. Deming | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Claiborne P. Deming | 225,011 | 5 | 200,028 | — | — | — | — | 425,039 | ||||||||||||||||||||||||||||||||||||||||||||||||

Lawrence R. Dickerson | 97,508 | 200,006 | — | — | — | 5,000 | 302,514 | |||||||||||||||||||||||||||||||||||||||||||||||||

Lawrence R. Dickerson | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Lawrence R. Dickerson | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Lawrence R. Dickerson | 117,000 | 200,028 | — | — | — | — | 317,028 | |||||||||||||||||||||||||||||||||||||||||||||||||

Michelle A. Earley | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Michelle A. Earley | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Michelle A. Earley | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Michelle A. Earley | 90,000 | 200,028 | — | — | — | 515 | 290,543 | |||||||||||||||||||||||||||||||||||||||||||||||||

Elisabeth W. Keller | 74,000 | 200,006 | — | — | — | 6,030 | 280,036 | |||||||||||||||||||||||||||||||||||||||||||||||||

Elisabeth W. Keller | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Elisabeth W. Keller | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Elisabeth W. Keller | 105,011 | 200,028 | — | — | — | 1,000 | 306,039 | |||||||||||||||||||||||||||||||||||||||||||||||||

James V. Kelley | 110,017 | 200,006 | — | — | — | — | 310,023 | |||||||||||||||||||||||||||||||||||||||||||||||||

Walentin Mirosh | 88,267 | 200,006 | — | — | — | — | 288,273 | |||||||||||||||||||||||||||||||||||||||||||||||||

James V. Kelley | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

James V. Kelley | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

James V. Kelley | 105,011 | 200,028 | — | — | — | — | 305,039 | |||||||||||||||||||||||||||||||||||||||||||||||||

R. Madison Murphy | 128,517 | 200,006 | — | — | 12,043 | 25,000 | 365,566 | |||||||||||||||||||||||||||||||||||||||||||||||||

R. Madison Murphy | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

R. Madison Murphy | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

R. Madison Murphy | 110,011 | 200,028 | — | — | 15,353 | 15,000 | 340,392 | |||||||||||||||||||||||||||||||||||||||||||||||||

Jeffrey W. Nolan | 98,017 | 200,006 | — | — | — | 6,210 | 304,233 | |||||||||||||||||||||||||||||||||||||||||||||||||

Neal E. Schmale | 122,517 | 200,006 | — | — | — | 25,000 | 347,523 | |||||||||||||||||||||||||||||||||||||||||||||||||

Jeffrey W. Nolan | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Jeffrey W. Nolan | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Jeffrey W. Nolan | 90,000 | 200,028 | — | — | — | — | 290,028 | |||||||||||||||||||||||||||||||||||||||||||||||||

Robert N. Ryan, Jr. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Robert N. Ryan, Jr. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Robert N. Ryan, Jr. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Robert N. Ryan, Jr. | 105,011 | 200,028 | — | — | — | 15,000 | 320,039 | |||||||||||||||||||||||||||||||||||||||||||||||||

Laura A. Sugg | 95,500 | 200,006 | — | — | — | — | 295,506 | |||||||||||||||||||||||||||||||||||||||||||||||||

Laura A. Sugg | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Laura A. Sugg | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Laura A. Sugg | 105,000 | 200,028 | — | — | — | 10,000 | 315,028 | |||||||||||||||||||||||||||||||||||||||||||||||||

Represents grant date fair value of time-based restricted stock units awarded in |

|

for the year ended December 31, 2023. |

Each non-employee director receives the same number of time-based restricted stock units as part of their annual compensation. Outstanding amounts listed below vary due to whether a director has elected to defer settlement of a restricted stock unit award. For further details regarding the number of shares of the Company’s common stock owned by all directors, please refer to the beneficial ownership table on page 42. At December 31, |

Restricted Stock Units | |||||

Claiborne P. Deming |

| 4,740 | |||

| |||||

|

| ||||

Lawrence R. Dickerson | 26,052 | ||||

Michelle A. Earley |

| 16,486 | |||

Elisabeth W. Keller |

| 4,740 | |||

James V. Kelley |

| 4,740 | |||

| |||||

R. Madison Murphy |

| 4,740 | |||

Jeffrey W. Nolan | 42,062 | ||||

Robert N. Ryan, Jr. |

| 4,740 | |||

| |||||

Laura A. Sugg |

| 42,062 | |||

The 1994 Retirement Plan forNon-Employee Directors was frozen on May 14, 2003. At that time, then current directors were vested based on their years of service, with no further benefits accruing and benefits being paid out according to the terms of the plan. Only Mr. Murphy continues to be eligible for benefits under the plan. |

| 4 | Total reflects matching charitable contributions the Company made on behalf of the directors for fiscal year 2023 pursuant to the Company’s Gift Matching Program. |

| 5 |

The director elected to defer payment of such amounts under the NED DCP Plan. |

As

14 MURPHY OIL CORPORATION

How You Can Communicate With Us

The Board values input from stockholders and other stakeholders and therefore provides a number of December 31, 2017,means for communication with the followingBoard. Stockholders are knownencouraged to communicate by voting on the Company to beitems in this proxy statement, by attending the beneficial owners of more than five percent ofannual meeting, by participating in the Company’s Common Stock (as of the date of such stockholder’s Schedule 13G filing with the SEC):

|

| |||||||

|

|

|

| |||||

| ||||||||

|

|

|

| |||||

| ||||||||

|

|

|

| |||||

| ||||||||

|

|

|

| |||||

| ||||||||

|

|

|

| |||||

| ||||||||

|

|

|

| |||||

| ||||||||

|

|

|

| |||||

| ||||||||

|

The following table sets forth information, as of February 20, 2018, concerning the number of shares of Common Stock of the Company beneficially owned by all directors and nominees, each of the Named Executive Officers (as hereinafter defined), and directors and executive officers as a group.

| Name

| Personal

| Personal as

| Voting and

| Options

| Total

| Percent of

| ||||||||||||||||||

Claiborne P. Deming

|

|

848,984

|

|

|

1,639,538

|

|

|

209,720

|

|

|

—

|

|

|

2,698,242

|

|

|

1.56

|

%

| ||||||

T. Jay Collins

|

|

10,599

|